Do You Pay Stamp Duty In Queensland . the duties act 2001 imposes transfer duty in queensland, having replaced the stamp act 1894. if the property you buy is valued at less than $700,000 then you don’t have to pay any stamp duty in queensland and. This tax, which applies to buying a home, can be expensive. you won’t have to pay transfer (stamp) duty on certain transactions. Transfer (stamp) duty applies when you buy or transfer property. We pay our respects to the aboriginal and torres strait islander ancestors of this land, their spirits and their legacy. concessions and exemptions are available to reduce the amount of transfer duty (sometimes called stamp. most property buyers in queensland have to pay stamp duty, also known as transfer duty. Find out which transactions are exempt from duty. It’s charged on transactions such as signing a contract to buy a house or business assets.

from www.caclubindia.com

concessions and exemptions are available to reduce the amount of transfer duty (sometimes called stamp. you won’t have to pay transfer (stamp) duty on certain transactions. Find out which transactions are exempt from duty. if the property you buy is valued at less than $700,000 then you don’t have to pay any stamp duty in queensland and. It’s charged on transactions such as signing a contract to buy a house or business assets. Transfer (stamp) duty applies when you buy or transfer property. This tax, which applies to buying a home, can be expensive. We pay our respects to the aboriginal and torres strait islander ancestors of this land, their spirits and their legacy. the duties act 2001 imposes transfer duty in queensland, having replaced the stamp act 1894. most property buyers in queensland have to pay stamp duty, also known as transfer duty.

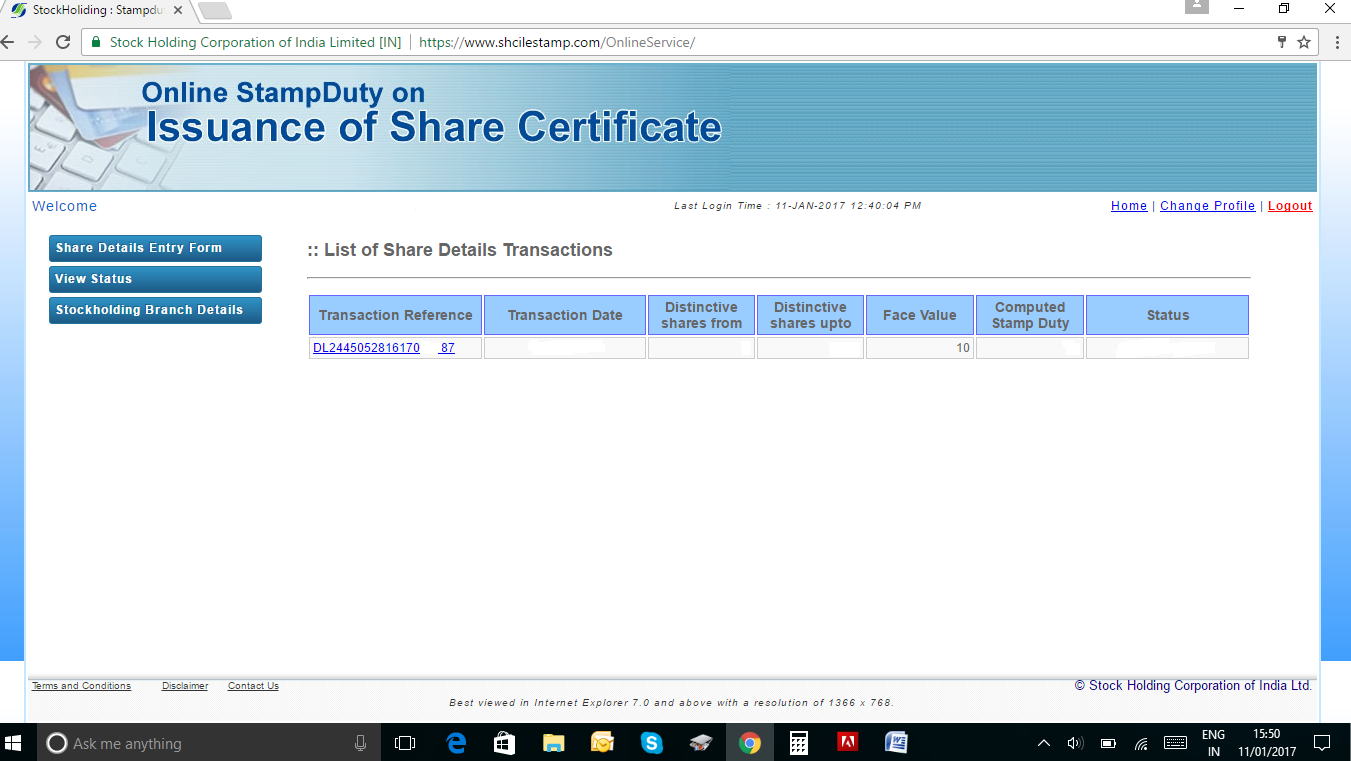

How to Pay Stamp Duty Online SHCIL

Do You Pay Stamp Duty In Queensland This tax, which applies to buying a home, can be expensive. you won’t have to pay transfer (stamp) duty on certain transactions. most property buyers in queensland have to pay stamp duty, also known as transfer duty. concessions and exemptions are available to reduce the amount of transfer duty (sometimes called stamp. We pay our respects to the aboriginal and torres strait islander ancestors of this land, their spirits and their legacy. It’s charged on transactions such as signing a contract to buy a house or business assets. This tax, which applies to buying a home, can be expensive. if the property you buy is valued at less than $700,000 then you don’t have to pay any stamp duty in queensland and. the duties act 2001 imposes transfer duty in queensland, having replaced the stamp act 1894. Transfer (stamp) duty applies when you buy or transfer property. Find out which transactions are exempt from duty.

From www.huntergalloway.com.au

Stamp Duty Calculator Queensland What does transfer duty cost in QLD? Do You Pay Stamp Duty In Queensland concessions and exemptions are available to reduce the amount of transfer duty (sometimes called stamp. you won’t have to pay transfer (stamp) duty on certain transactions. Transfer (stamp) duty applies when you buy or transfer property. It’s charged on transactions such as signing a contract to buy a house or business assets. most property buyers in queensland. Do You Pay Stamp Duty In Queensland.

From www.rivercityconveyancing.com.au

Stamp Duty Qld Do You Pay Stamp Duty In Queensland Find out which transactions are exempt from duty. This tax, which applies to buying a home, can be expensive. We pay our respects to the aboriginal and torres strait islander ancestors of this land, their spirits and their legacy. concessions and exemptions are available to reduce the amount of transfer duty (sometimes called stamp. most property buyers in. Do You Pay Stamp Duty In Queensland.

From www.buildi.com.au

Do I need to pay stamp duty when building a house in QLD? Buildi Do You Pay Stamp Duty In Queensland you won’t have to pay transfer (stamp) duty on certain transactions. Transfer (stamp) duty applies when you buy or transfer property. We pay our respects to the aboriginal and torres strait islander ancestors of this land, their spirits and their legacy. the duties act 2001 imposes transfer duty in queensland, having replaced the stamp act 1894. concessions. Do You Pay Stamp Duty In Queensland.

From www.huntergalloway.com.au

Stamp Duty Calculator Queensland What does transfer duty cost in QLD? Do You Pay Stamp Duty In Queensland the duties act 2001 imposes transfer duty in queensland, having replaced the stamp act 1894. if the property you buy is valued at less than $700,000 then you don’t have to pay any stamp duty in queensland and. We pay our respects to the aboriginal and torres strait islander ancestors of this land, their spirits and their legacy.. Do You Pay Stamp Duty In Queensland.

From www.yourmortgage.com.au

Stamp Duty 101 What you need to know about land transfer duty in Do You Pay Stamp Duty In Queensland We pay our respects to the aboriginal and torres strait islander ancestors of this land, their spirits and their legacy. most property buyers in queensland have to pay stamp duty, also known as transfer duty. It’s charged on transactions such as signing a contract to buy a house or business assets. the duties act 2001 imposes transfer duty. Do You Pay Stamp Duty In Queensland.

From www.deadlinenews.co.uk

What is stamp duty and why do I need it for a buytolet property Do You Pay Stamp Duty In Queensland Transfer (stamp) duty applies when you buy or transfer property. you won’t have to pay transfer (stamp) duty on certain transactions. the duties act 2001 imposes transfer duty in queensland, having replaced the stamp act 1894. if the property you buy is valued at less than $700,000 then you don’t have to pay any stamp duty in. Do You Pay Stamp Duty In Queensland.

From www.lendi.com.au

Stamp Duty in QLD Lendi Do You Pay Stamp Duty In Queensland Find out which transactions are exempt from duty. the duties act 2001 imposes transfer duty in queensland, having replaced the stamp act 1894. you won’t have to pay transfer (stamp) duty on certain transactions. most property buyers in queensland have to pay stamp duty, also known as transfer duty. It’s charged on transactions such as signing a. Do You Pay Stamp Duty In Queensland.

From www.urban.com.au

What is stamp duty? A guide to stamp duty in Queensland Do You Pay Stamp Duty In Queensland It’s charged on transactions such as signing a contract to buy a house or business assets. most property buyers in queensland have to pay stamp duty, also known as transfer duty. concessions and exemptions are available to reduce the amount of transfer duty (sometimes called stamp. if the property you buy is valued at less than $700,000. Do You Pay Stamp Duty In Queensland.

From www.yourmortgage.com.au

Stamp Duty 101 What you need to know about land transfer duty in Do You Pay Stamp Duty In Queensland It’s charged on transactions such as signing a contract to buy a house or business assets. concessions and exemptions are available to reduce the amount of transfer duty (sometimes called stamp. if the property you buy is valued at less than $700,000 then you don’t have to pay any stamp duty in queensland and. This tax, which applies. Do You Pay Stamp Duty In Queensland.

From www.aussie.com.au

How does stamp duty work in Queensland? Aussie Home Loans Do You Pay Stamp Duty In Queensland you won’t have to pay transfer (stamp) duty on certain transactions. if the property you buy is valued at less than $700,000 then you don’t have to pay any stamp duty in queensland and. It’s charged on transactions such as signing a contract to buy a house or business assets. Transfer (stamp) duty applies when you buy or. Do You Pay Stamp Duty In Queensland.

From quickbooks.intuit.com

Stamp Duty in Queensland QuickBooks Australia Do You Pay Stamp Duty In Queensland This tax, which applies to buying a home, can be expensive. concessions and exemptions are available to reduce the amount of transfer duty (sometimes called stamp. if the property you buy is valued at less than $700,000 then you don’t have to pay any stamp duty in queensland and. the duties act 2001 imposes transfer duty in. Do You Pay Stamp Duty In Queensland.

From www.comparethemarket.com.au

Stamp duty calculator QLD Compare the Market Do You Pay Stamp Duty In Queensland We pay our respects to the aboriginal and torres strait islander ancestors of this land, their spirits and their legacy. concessions and exemptions are available to reduce the amount of transfer duty (sometimes called stamp. most property buyers in queensland have to pay stamp duty, also known as transfer duty. if the property you buy is valued. Do You Pay Stamp Duty In Queensland.

From www.realestate.com.au

Your ultimate guide to stamp duty in Queensland Do You Pay Stamp Duty In Queensland We pay our respects to the aboriginal and torres strait islander ancestors of this land, their spirits and their legacy. most property buyers in queensland have to pay stamp duty, also known as transfer duty. you won’t have to pay transfer (stamp) duty on certain transactions. concessions and exemptions are available to reduce the amount of transfer. Do You Pay Stamp Duty In Queensland.

From www.caclubindia.com

How to Pay Stamp Duty Online SHCIL Do You Pay Stamp Duty In Queensland the duties act 2001 imposes transfer duty in queensland, having replaced the stamp act 1894. Find out which transactions are exempt from duty. This tax, which applies to buying a home, can be expensive. It’s charged on transactions such as signing a contract to buy a house or business assets. concessions and exemptions are available to reduce the. Do You Pay Stamp Duty In Queensland.

From www.caclubindia.com

How to Pay Stamp Duty Online SHCIL Do You Pay Stamp Duty In Queensland most property buyers in queensland have to pay stamp duty, also known as transfer duty. if the property you buy is valued at less than $700,000 then you don’t have to pay any stamp duty in queensland and. Transfer (stamp) duty applies when you buy or transfer property. you won’t have to pay transfer (stamp) duty on. Do You Pay Stamp Duty In Queensland.

From www.yourmortgage.com.au

Stamp Duty 101 Land Transfer duty in Australia Your Mortgage Do You Pay Stamp Duty In Queensland It’s charged on transactions such as signing a contract to buy a house or business assets. the duties act 2001 imposes transfer duty in queensland, having replaced the stamp act 1894. most property buyers in queensland have to pay stamp duty, also known as transfer duty. Transfer (stamp) duty applies when you buy or transfer property. you. Do You Pay Stamp Duty In Queensland.

From www.yourmortgage.com.au

Stamp Duty 101 What you need to know about land transfer duty in Do You Pay Stamp Duty In Queensland most property buyers in queensland have to pay stamp duty, also known as transfer duty. This tax, which applies to buying a home, can be expensive. We pay our respects to the aboriginal and torres strait islander ancestors of this land, their spirits and their legacy. the duties act 2001 imposes transfer duty in queensland, having replaced the. Do You Pay Stamp Duty In Queensland.

From www.yourmortgage.com.au

Stamp Duty 101 What you need to know about land transfer duty in Do You Pay Stamp Duty In Queensland concessions and exemptions are available to reduce the amount of transfer duty (sometimes called stamp. This tax, which applies to buying a home, can be expensive. Find out which transactions are exempt from duty. We pay our respects to the aboriginal and torres strait islander ancestors of this land, their spirits and their legacy. the duties act 2001. Do You Pay Stamp Duty In Queensland.